When you’re first learning how to budget, it feels hard and restrictive. Here are a few tips on how to budget to get you over the initial budgeting learning curve.

Budget tip 1: Create a why

When you first start learning how to budget, you should first create a why. Why do you want to budget?

Are you feeling like you don’t have control over your money? Are you not saving money? Are you wanting to change your family tree?

It’s helpful to align to something bigger so that if budgeting gets confusing, you have a way to push through the short term budgeting difficulty.

Budget tip 2: Have fun learning how to budget!

Money is emotional. People are emotional. We need emotions to survive and thrive.

When looking for tips on how to budget, it’s important to feel your emotions and not suppress them. If you feel anxious, explore why.

If you notice your heart rate rises every time you sit down to review your budget, ask why.

Feel the feelings and let it guide you.

Remember that a budget is not created to restrict yourself or limit your fun, but it is created to provide you freedom so you can spend intentionally in alignment with your why.

Let the budget guide you to a high level and provide you confidence that you know where your money is, but realize that you’ll never be perfect with your budget.

It’s okay to not be perfect with your budget!

Once you accept that it’s designed to provide you freedom, then you can have fun budgeting.

Budget tip 3: Don’t let money myths hold you back from learning how to budget

When I first start working with clients during financial coaching, they tend to believe certain money myths.

Realize that it’s okay to feel these emotions around money.

Don’t let them hold you back from starting to learn how to budget, though. Just because you haven’t been good at budgeting historically doesn’t mean you can’t be good at budgeting next week or next year.

If the word budget makes you feel yucky, then change the name!

In my household, we call it the family wealth party.

Budget tip 4: Use an online budget tool

Wanna know how to make budgeting easier?

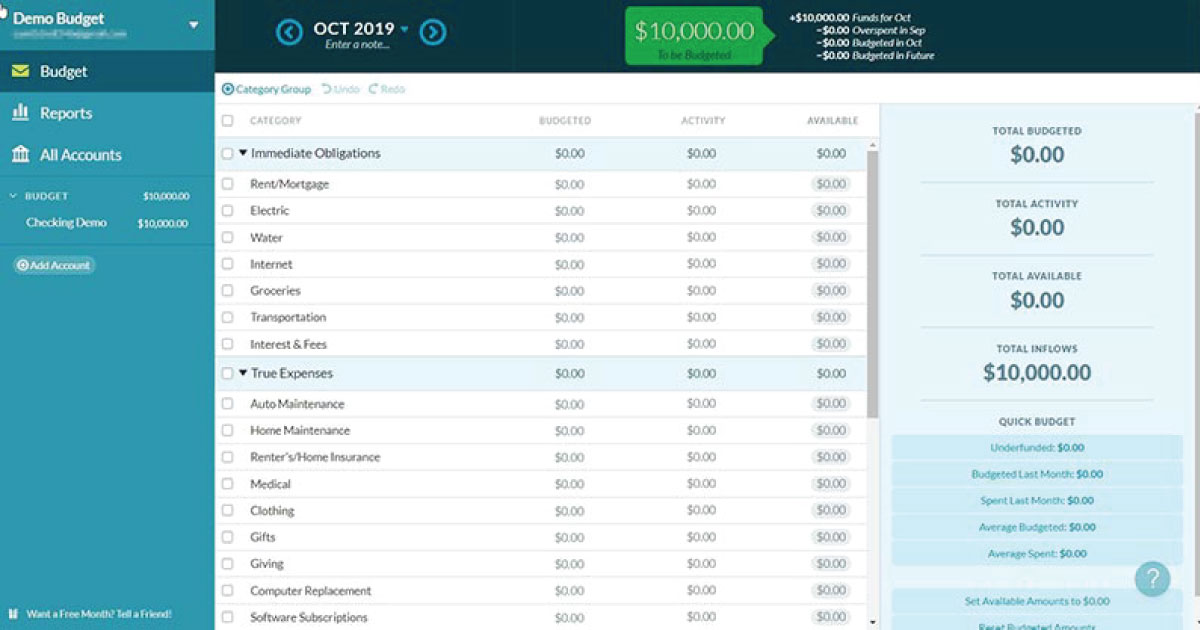

Let budgeting software like YNAB do the heavy lifting!

Some people are spreadsheet junkies and have the discipline to be consistent with managing finances manually, but most don’t.

Budgeting tools like YNAB change the way you look at money and make it so much easier to be consistent with your weekly and monthly YNAB reviews.

Budget tip 5: Pay attention to detail when learning how to budget

I know, you’re thinking “eh, it’s off just $10. It doesn’t matter.” But if you say that in 5 different budget categories, that’s $600/year just in rounding.

You should always operate to help your future self.

In terms of budgeting, this means adding appropriate descriptions to help you remember what you spent money on. Or splitting transactions into different categories to be more accurate with your budget.

The more you help your future self, the easier it will be to look back on your budgeting reports to develop trends.

Budget tip 6: Automate your budget where possible

When it comes to money, we are our own worst enemy.

We make too many decisions and therefore end up making suboptimal decisions before realizing any benefit.

Know your weak spots.

If you have trouble saving money, then set up automatic transfers to send your money to separate bank accounts.

Set up all of your bills to automatically pay, so you don’t have to remember due dates. Auto pay your credit card statement balance (never the minimum balance!).

Create a system that works with minimal input from you so you can remove decisions from your life.

Some service providers even offer discounts for paying annually instead of monthly so you can save money too!

Budget tip 7: Focus on net worth growth when learning how to budget

By shifting your focus to net worth growth, you align yourself with the bigger picture of your life.

An increased net worth creates financial freedom.

If you make $1 million and spend $1 million, you’ve created no wealth. If you make $1 million and spend $500,000 then you’ve created $500,000 of wealth.

How can you save and invest that wealth to increase your financial freedom?

When you pull together your net worth, this lets you zoom out and see your entire financial picture.

Budget tip 8: Create an emergency fund

An emergency fund will help shield you from short term emergencies.

By using a budgeting tool like YNAB, you can set aside money for your emergency fund and remove any fear of short term financial changes setting you back.

3-6 months of an emergency fund is always recommended.

Budget tip 9: Pay your financial debts

If you have financial debts, this is likely a great place to start your financial health journey.

Pay off credit cards and any other high interest debts first.

Creating your net worth will help you see your overall financial picture to determine where to focus your efforts.

By paying off your debts, you create cash flow that can then be shifted toward your other financial goals.

Budget tip 10: Give yourself grace if you overspend

Don’t be restricted by your budget. It isn’t created to make you feel like you can’t live.

You will likely overspend and that’s okay.

The big picture is that you have a strategy with your money, you have an idea of where you spend your money, and you can feel in control of your money.

Budget tip 11: Stick to a review schedule

Budget tip 12: Talk to your partner about money

Remember that each of you likely have developed beliefs about money as a result of the way you were raised.

Those beliefs may not be aligned with your spouse. Find ways to communicate through your different viewpoints.

Budget tip 13: Set financial goals

After you align to your why and pull together your net worth, you can then set financial goals.

Do you want to pay off your financial debts? Do you need to create an emergency fund? Do you want to save for a new fence?

Setting financial goals will help you move forward as a couple on the same page financially.